Dalmia Bharat Share Price Target 2023, 2024, 2025, 2026, 2030, 2040: Dalmia Bharat is one of India’s leading companies in the cement sector.

From the beginning of the company and to date, the company has emerged as a good resource for the cement sector. It has a good track record of performance, growth, and customer care.

Dalmia Bharat has a presence in all the segments of cement and green energy. The peer companies of Dalmia Bharat are Ambuja Cements, UltraTechCement, Shree Cements, and ACC.

If you are an investor who has put his money in Dalmia Bharat or wants to invest in the future then you are at the right place. we will discuss all the possible prices of Dalmia Bharat, and when to hold or sell it.

Dalmia Bharat all-time chart

If you want to invest in Dalmia Bharat and are curious to know about the future and the value of the share, you are reading the exact article and we are going to provide details information about Dalmia Bharat Share Price Target 2023, 2024, 2025, 2030, 2030, 2040 and we will also do a fundamental analysis of the share.

Table of Contents

Dalmia Bharat Company Overview

| Company Name | Dalmia Bharat |

| P/E | 33.66 |

| Sector P/E | NA |

| Current Ratio | NA |

| Free cash Flow | 96 |

| Debt | NA |

| 52-Week High/Low | ₹ 1,803.15 / ₹ 2,430.70 |

| Number of Shares | NA |

| Market Cap | ₹ 37.02TCr |

| Website | Dalmia Bharat |

Dalmia Bharat Share Price Target 2024

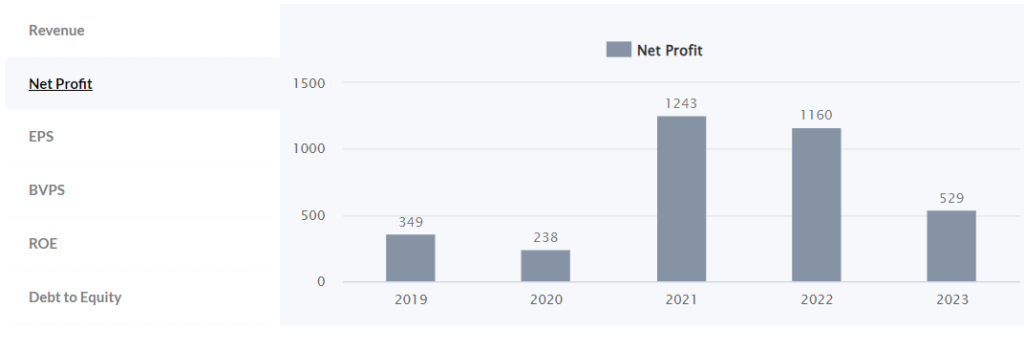

Dalmia Bharat share price target 2024 is expected to be around 2570. The company is showing a good amount of profit in year on year basis. with the help of the below chart, you can see the company has been in profit for more than 5 years. which is a good sign.

Dalmia Bharat Share Price Target 2025

the company has started making a profit and in the last 5 years, the growth has been great. if we see the revenue for the last 5 quarters we can easily see the growth is good and the profit margin is more than enough to say that company is working well.

In the last quarter, the company had a revenue of rs 13540 crore and made a net profit of rs 529 crores.

| By Month | Share Price Target |

| January 2025 | ₹3000 |

| February 2025 | ₹3020 |

| March 2025 | ₹3030 |

| April 2025 | ₹3010 |

| May 2025 | ₹3040 |

| June 2025 | ₹3030 |

| July 205 | ₹3030 |

| August 2025 | ₹3010 |

| September 2025 | ₹3050 |

| October 2025 | ₹4000 |

| November 2025 | ₹3050 |

| December 2025 | ₹3020 |

Dalmia Bharat Share Price Target 2030

From company’s core business is generating less business but the company is making a good amount of profit on a year-to-year basis. you can check the price target by 2030.

| By Month | Share Price Target |

| January 2030 | ₹4000 |

| February 2030 | ₹4060 |

| March 2030 | ₹4030 |

| April 2030 | ₹4000 |

| May 2030 | ₹4060 |

| June 2030 | ₹4030 |

| July 2030 | ₹4000 |

| August 2030 | ₹4000 |

| September 2030 | ₹4030 |

| October 2030 | ₹4000 |

| November 2030 | ₹4070 |

| December 2030 | ₹4030 |

Dalmia Bharat’s Share price target in 2030 minimum is ₹3500and the maximum is ₹4100.

Dalmia Bharat Share Price Target 2040

By the year 2040, Dalmia Bharat share price target 2040 is expected to touch more than rs 7000. The company is showing a good amount of progress and the year-on-year profit margin is also being increased.

It is expected to touch the price is around 5000 as the company has a huge potential for growth and given the part of Tata Enterprises, it can easily scale its business.

Dalmia Bharat Share Price Target 2040 to 2050

| Years | Share Price Target |

| 2023 | ₹1900 |

| 2025 | ₹3000 |

| 2030 | ₹4000 |

| 2040 | ₹7000 |

| 2050 | ₹10000 (Approx) |

Dalmia Bharat Share strengths and weaknesses

Strength

- The company has shown good financials and profitability in the last 5 years and the profit margin is also increasing.

Weaknesses

- The company has a big debt to repay.

- The company’s competitors are also making a profit and expanding the business.

Dalmia Bharat Share Shareholding Pattern

The number of promoters has remained almost the same in the last 1 year which is a good sign. Since less than .21% of promoters have diluted their holdings. it stands at 55.54%. the holdings of DII have also increased by 2% and DII stands at 11.17%.

| Holders | Sep 2022 | Dec 2023 |

| Promoters | 55.85% | 55.54% |

| FIIs | 14.11% | 12.96% |

| DIIs | 9.57% | 11.17% |

| Public | 20.44% | 20.2% |

| Others | 0.1% | 0.1% |

Conclusion

As of 2023, Dalmia Bharat’s Share price is showing a good sign of recovery and providing good results and in the last 5 years it has shown profit. the profit is increasing the company is growing its business in different part of the country. it seems that the company has a bright future and a good place to invest the money.

Disclaimer

Any target mentioned on this website is taken by our personal analysis, and we are not SEBI registered advisors, our objective is only to provide detailed information related to the company’s business to the public. Investors should conduct their own research and analysis and consult with financial experts before making any investment decisions.