Ambuja Cements Share Price Target 2023, 2024, 2025, 2026, 2030, 2040: Ambuja Cements is one of the leading cement manufacturing companies in India. It is part of the global conglomerate LafargeHolcim, which is one of the largest cement producers in the world.

Ambuja Cements was established in 1983 as a joint venture between Holcim (a Swiss-based global building materials company) and the Gujarat Industrial Investment Corporation (GIIC). Over the years, it has grown to become one of the most prominent players in the Indian cement market.

The company primarily produces various types of cement, including Ordinary Portland Cement (OPC), Portland Pozzolana Cement (PPC), and ready-mix concrete. These products cater to the construction industry for both residential and commercial projects.

The peer companies of Ambuja Cements are UltraTechCement, Shree Cements, Dalmia Bharat, and ACC.

If you are an investor who has put his money in Ambuja Cements or wants to invest in the future then you are at the right place. we will discuss all the possible prices of Ambuja Cement and when to hold or sell it.

Ambuja Cements all-time chart

If you want to invest in Ambuja Cement and are curious to know about the future and the value of the share, you are reading the exact article and we are going to provide details information about Ambuja Cement Share Price Target 2022, 2023, 2024, 2025, 2030, 2030, 2040 and we will also do a fundamental analysis of the share.

Table of Contents

Ambuja Cement Company Overview

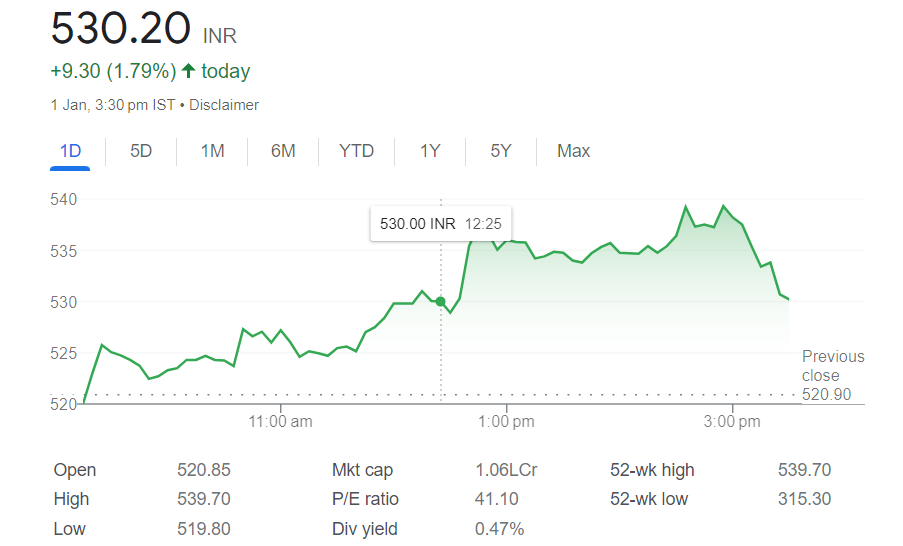

| Company Name | Ambuja Cement |

| P/E | 41.10 |

| Sector P/E | N/A |

| Current Ratio | 23 |

| Free cash Flow | 53 billion |

| Debt | $4.5 billion |

| 52-Week Low/High | ₹ 315.30/₹ 539.70 |

| Number of Shares | 2,686,563 Crore |

| Market Cap | ₹ 1.06 trillion |

| Website | Ambuja Cement |

Ambuja Cement Share Price Target 2023

Ambuja Cement share price target in 2023 is expected to be around 515. The company is showing a good amount of profit in year on year basis. you can see, with the help of the below chart, the company has been in profit for more than 5 years. which is a good sign and also the revenue is increasing.

Ambuja Cements Share Price Target in the Next 1, 3, 5, 7, and 10 Years

| Period | Share Price Target 1 | Share Price Target 2 |

|---|---|---|

| 1 Year | ₹650 | ₹670 |

| 2 Years | ₹672 | ₹720 |

| 3 Years | ₹742 | ₹805 |

| 4 Years | ₹840 | ₹889 |

| 5 Years | ₹899 | ₹957 |

| 6 Years | ₹980 | ₹1,044 |

| 7 Years | ₹1,099 | ₹1,126 |

| 8 Years | ₹1,188 | ₹1,205 |

| 9 Years | ₹1,199 | ₹1,299 |

| 10 Years | ₹1,279 | ₹1,370 |

Ambuja Cement Share Price Target 2024

the company has started making a profit and in the last 5 years, the growth has been great. if we see the revenue for the last 5 quarters we can easily see the growth is good and the profit margin is more than enough to say that company is working well.

| 2023 | Share Price Target 1 | Share Price Target 2 |

|---|---|---|

| January | 600 | 640 |

| February | 600 | 650 |

| March | 590 | 670 |

| April | 560 | 690 |

| May | 640 | 700 |

| June | 699 | 730 |

| July | 680 | 650 |

| August | 650 | 777 |

| September | 700 | 654 |

| October | 720 | 632 |

| November | 770 | 620 |

| December | 750 | 800 |

Ambuja Cement Share Price Target 2023, 2025, 2027, 2030, 2035

From company’s core business is generating less business but the company is making a good amount of profit on a year-to-year basis. you can check the price target by 2035.

| Year | Share Price Target 1 | Share Price Target 2 |

|---|---|---|

| 2023 | 515 | 520 |

| 2024 | ₹600 | ₹642 |

| 2025 | ₹672 | ₹720 |

| 2026 | ₹747 | ₹805 |

| 2027 | ₹820 | ₹889 |

| 2028 | ₹891 | ₹957 |

| 2029 | ₹970 | ₹1,042 |

| 2030 | ₹1,046 | ₹1,124 |

| 2031 | ₹1,121 | ₹1,205 |

| 2035 | ₹1,424 | ₹1,532 |

Ambuja Cement Share price target in 2030 minimum is ₹ 1046and the maximum is ₹1120

Ambuja Cements Share Price Target 2025

| 2025 | Share Price Target 1 | Share Price Target 2 |

|---|---|---|

| January | ₹594 | ₹638 |

| February | ₹593 | ₹635 |

| March | ₹601 | ₹645 |

| April | ₹611 | ₹653 |

| May | ₹617 | ₹660 |

| June | ₹625 | ₹666 |

| July | ₹641 | ₹686 |

| August | ₹646 | ₹691 |

| September | ₹660 | ₹707 |

| October | ₹664 | ₹706 |

| November | ₹669 | ₹712 |

| December | ₹672 | ₹720 |

Ambuja Cements Share Price Target 2026

| 2026 | Share Price Target 1 | Share Price Target 2 |

|---|---|---|

| January | ₹700 | ₹715 |

| February | ₹667 | ₹719 |

| March | ₹679 | ₹728 |

| April | ₹685 | ₹739 |

| May | ₹692 | ₹733 |

| June | ₹702 | ₹745 |

| July | ₹711 | ₹769 |

| August | ₹725 | ₹771 |

| September | ₹733 | ₹782 |

| October | ₹732 | ₹785 |

| November | ₹744 | ₹793 |

| December | ₹748 | ₹801 |

Ambuja Cements Share Price Target 2027

| 2027 | Share Price Target 1 | Share Price Target 2 |

|---|---|---|

| January | ₹749 | ₹808 |

| February | ₹755 | ₹796 |

| March | ₹741 | ₹801 |

| April | ₹753 | ₹812 |

| May | ₹765 | ₹828 |

| June | ₹771 | ₹836 |

| July | ₹784 | ₹854 |

| August | ₹733 | ₹859 |

| September | ₹829 | ₹879 |

| October | ₹822 | ₹879 |

| November | ₹833 | ₹883 |

| December | ₹821 | ₹881 |

Ambuja Cement Share Shareholding Pattern

The number of promoters has remained the same in the last 1 year which is a good sign. Since no promoters have diluted their holdings. it stands at 63.22%. the holdings of DII have also increased by 0.60% and DII stands at 15.52%.

| Holders | Sep 2022 | Sep 2023 |

| Promoters | 63.22% | 63.19% |

| FIIs | 11.05% | 11.65% |

| DIIs | 16.53% | 15.52% |

| Public | 9.22% | 9.63% |

| Others | 0% | 0.01% |

Conclusion

As of 2023, Ambuja Cement’s Share price is showing a good sign of recovery and providing good results and in the last 5 years it has shown profit. the profit is increasing the company is growing its business in different parts of the country. it seems that the company has a bright future and a good place to invest the money.

Disclaimer

Any target mentioned on this website is taken by our analysis, and we are not SEBI registered advisors, our objective is only to provide detailed information related to the company’s business to the public. Investors should conduct their research and analysis and consult with financial experts before making any investment decisions.

What is the share price of Ambuja Cement

The share price of Ambuja Cement is 515 as of 2024.

What is the price of Ambuja Cement today

Ambuja cement price stands at 515 as of 1st January 2025.

Who owns Ambuja Cement

Ambuja Cement is owned by Adani Group.

who is the owner of Ambuja Cement

Adani Group owns Ambuja Cement.